The survey, which included 1,263 participants from 350 cities across the country, revealed that women were more meticulous in selecting their tax regime.About 74% of women chose their tax regime based on careful calculations, compared to 71% of men, according to an ET report quoting the survey.

Among those who preferred long-term investment plans and stuck to the old regime, provident fund (PF) investments remained the most popular, followed by life insurance and other life insurance instruments.Sarbvir Singh, joint group CEO of PB Fintech, commented that the fact that 80% of individuals made a conscious choice based on tax liability reflects collective financial prudence. According to Singh, this foresight was observed across different tiers, income groups, age groups, and genders.

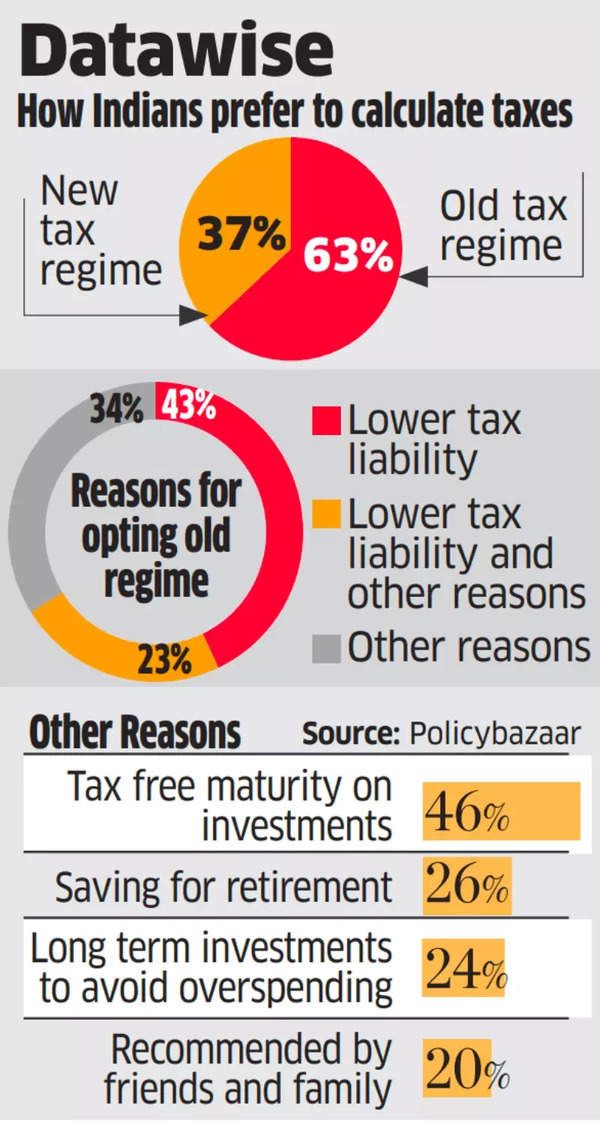

How Indians prefer to calculate taxes

Out of the respondents, 82% were men and 15% were women. Furthermore, 67% were salaried individuals, 15% were business professionals, 6% were professionals such as lawyers and doctors, and 12% were retired.

New Income Tax Regime Vs Old Regime: It’s IMPORTANT TO DECIDE NOW | Income Tax Slabs 2023-24

The survey also discovered that one-third of the participants did not perform any calculations before selecting their income tax regime. Among the remaining two-thirds, 38% based their decision on advice from financial advisors.

Approximately 46% of respondents favored the old income tax regime due to the tax-free status of their long-term investments. The survey revealed that 67% of salaried individuals stuck with the old income tax regime, while 49% of businesspersons preferred the new income tax regime.

The new income tax regime is now the default income tax regime from financial year 2023-24, that is for assessment year 2024-25. Individuals opting for the old income tax regime will have to choose the option when filing their income tax returns.